A Comprehensive Guide to Forex Trading in Kenya for Beginners

Introduction to Forex Trading

Forex trading, also known as foreign exchange trading, is the process of buying and selling currencies on the global market with the intent of making a profit. The fundamental notion behind Forex trading is to profit from changes in currency values. Unlike stock trading, which focuses on purchasing shares of companies, Forex trading involves currency pairs, which represent the value of one currency relative to another.

The Forex market is the largest and most liquid financial market in the world, operating 24 hours a day, five days a week. It accommodates a vast array of participants, including banks, financial institutions, corporations, individual traders, and retail investors. This dynamic market is accessible to anyone with an internet connection and a trading account, making it an attractive avenue for those looking to invest and trade.

Central to understanding Forex trading is the concept of currency pairs. A currency pair consists of two currencies, where one is the base currency and the other is the quote currency. For instance, in the currency pair EUR/USD, the Euro serves as the base currency, while the US Dollar is the quote currency. The price of the pair reflects how much of the quote currency is needed to purchase one unit of the base currency.

Additionally, key terms such as ‘pips’ (which refer to the smallest price movement in a currency pair) and ‘spread’ (the difference between the buying and selling price) are fundamental concepts that traders should familiarize themselves with. Understanding these elements provides a foundation for evaluating potential trades and market trends. For beginners, grasping these basic concepts of Forex trading is crucial before delving deeper into strategies and market analysis.

The Forex Market in Kenya

The Forex market in Kenya has witnessed significant growth over the past decade, evolving into a critical component of the nation’s financial landscape. With the advent of technology and increased internet access, a rising number of Kenyans are engaging in Forex trading, attracted by the prospects of high returns and global market participation. This burgeoning interest has led to the emergence of numerous online trading platforms that facilitate access to the Forex market, making it more inclusive for beginners interested in trading currencies.

The Capital Markets Authority (CMA) plays an essential role in regulating Forex trading in Kenya. Established to safeguard investor interests, the CMA provides guidelines and oversight for Forex brokers and traders. This regulatory framework is crucial in promoting fair trading practices, enhancing market integrity, and preventing fraudulent activities within this dynamic market. The CMA’s efforts to educate and inform potential traders also contribute to a more informed trading community, thereby fostering a sustainable Forex ecosystem in Kenya.

Setting Up for Forex Trading

Embarking on a journey in Forex trading is an exciting yet intricate endeavor, especially for beginners in Kenya. The first step in this process is to choose a reliable broker. A broker acts as an intermediary between traders and the market, and selecting a trustworthy one is pivotal. It’s crucial to consider factors such as regulatory compliance, customer support quality, trading fees, and user reviews before making a decision. Regulatory bodies in Kenya endorse certain brokers, ensuring they provide safe and transparent trading environments.

After identifying a suitable broker, the next step involves understanding the various account types they offer. Most brokers provide demo accounts, which are invaluable for beginners. A demo account allows aspiring traders to practice their skills without financial risk by using virtual currency. This practice helps familiarize oneself with the trading platform and market conditions. Once comfortable, traders can transition to a live account, where real funds are used to execute trades. Selecting the right type of account aligns with one’s trading strategy and risk appetite.

Registration for a trading account typically requires a few essential documents. These documents may include a valid identification card, proof of residence, and sometimes a tax identification number. Ensuring these documents are readily available expedites the registration process. Furthermore, the selection of a trading platform cannot be overstated, as it is the primary interface for executing trades. A platform should be user-friendly and equipped with necessary tools for analysis, such as charting software and technical indicators. Researching different platforms can lead to finding one that meets individual needs, ultimately contributing to a successful trading experience.

Understanding Currency Pairs

In the realm of Forex trading, currency pairs are the foundational elements that define how trading occurs on this global platform. A currency pair essentially consists of two currencies, where one is purchased while the other is sold simultaneously. The first currency in the pair is known as the base currency, while the second is referred to as the quote currency. The exchange rate expresses how much of the quote currency is required to purchase one unit of the base currency.

There are three main categories of currency pairs: major, minor, and exotic pairs. Major pairs typically involve the most traded currencies globally, including the US Dollar (USD), Euro (EUR), and British Pound (GBP). For instance, the EUR/USD pair indicates how many US dollars are required to purchase one Euro, making it a popular choice among traders due to its liquidity and tight spreads.

Minor currency pairs, on the other hand, do not include the US Dollar but feature other significant global currencies, such as the Euro and the British Pound. A good example of a minor pair is the GBP/JPY, which consists of the British Pound and the Japanese Yen. These pairs are commonly traded, though they may exhibit greater volatility compared to major pairs.

Lastly, exotic pairs involve one major currency and a currency from a developing or emerging economy, such as the USD/TRY (Turkish Lira) or EUR/ZAR (South African Rand). While exotic pairs can present unique trading opportunities with large potential price swings, they often come with wider spreads and lower liquidity.

Several factors can influence the movements of currency pairs, including economic indicators, geopolitical events, and market sentiment. Understanding these influences is crucial for Forex traders to effectively navigate the financial landscape and make informed trading decisions.

Basic Trading Strategies for Beginners

Forex trading can be an intricate field, especially for novices just embarking on their trading journey. To create a solid foundation, it is essential to understand some basic trading strategies that can help beginners navigate the market effectively. One of the most straightforward strategies is trend following. This strategy involves identifying the direction of the market—whether it is moving upward or downward—and aligning trades with this prevailing momentum. By observing trends, traders can make informed decisions and increase their chances of profit.

Another popular strategy among beginners is range trading. This approach relies on identifying price levels where a currency pair consistently oscillates between support and resistance. Traders enter buy orders when the price approaches the support level and sell orders when it nears the resistance level. This method allows traders to capitalize on price fluctuations without needing extensive market analysis skills.

Breakout strategies represent a more dynamic approach, wherein traders look for points at which the price breaks through predefined support or resistance levels. A breakout often indicates a significant price movement in the direction of the breakout. By using this strategy, traders can position themselves to capitalize on the increased volatility that typically follows a breakout.

An essential aspect of these trading strategies is the incorporation of sound risk management practices. Understanding how to define entry and exit points is crucial to protecting capital. Employing stop-loss and take-profit orders can effectively safeguard investments. A stop-loss order allows traders to set a predetermined price point where their position will be automatically closed to prevent further losses, while a take-profit order secures profits by closing a trade when it reaches a specified level. By incorporating these strategies and risk management techniques, beginners can build a strong foundation for their forex trading endeavors.

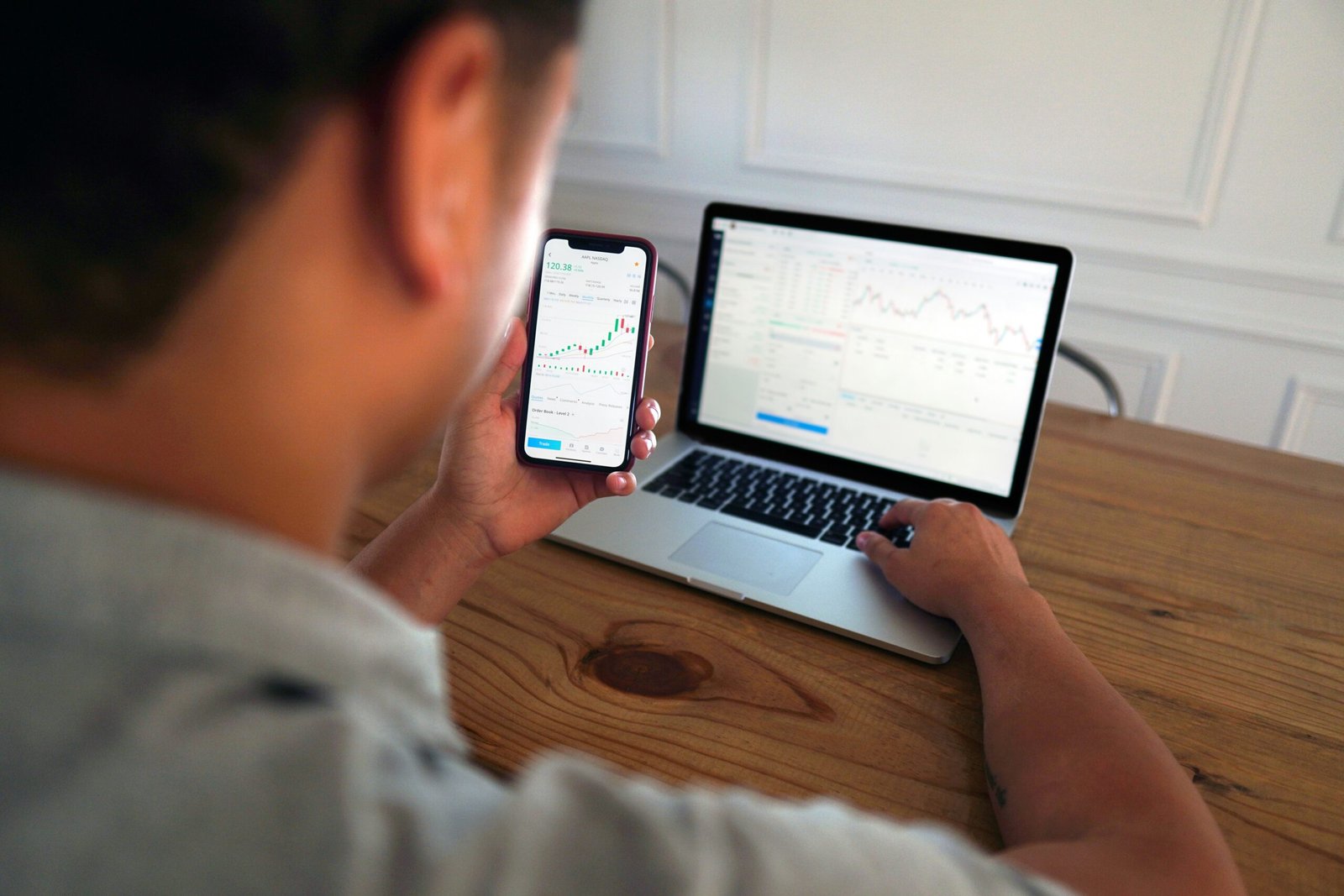

Technical Analysis and Chart Reading

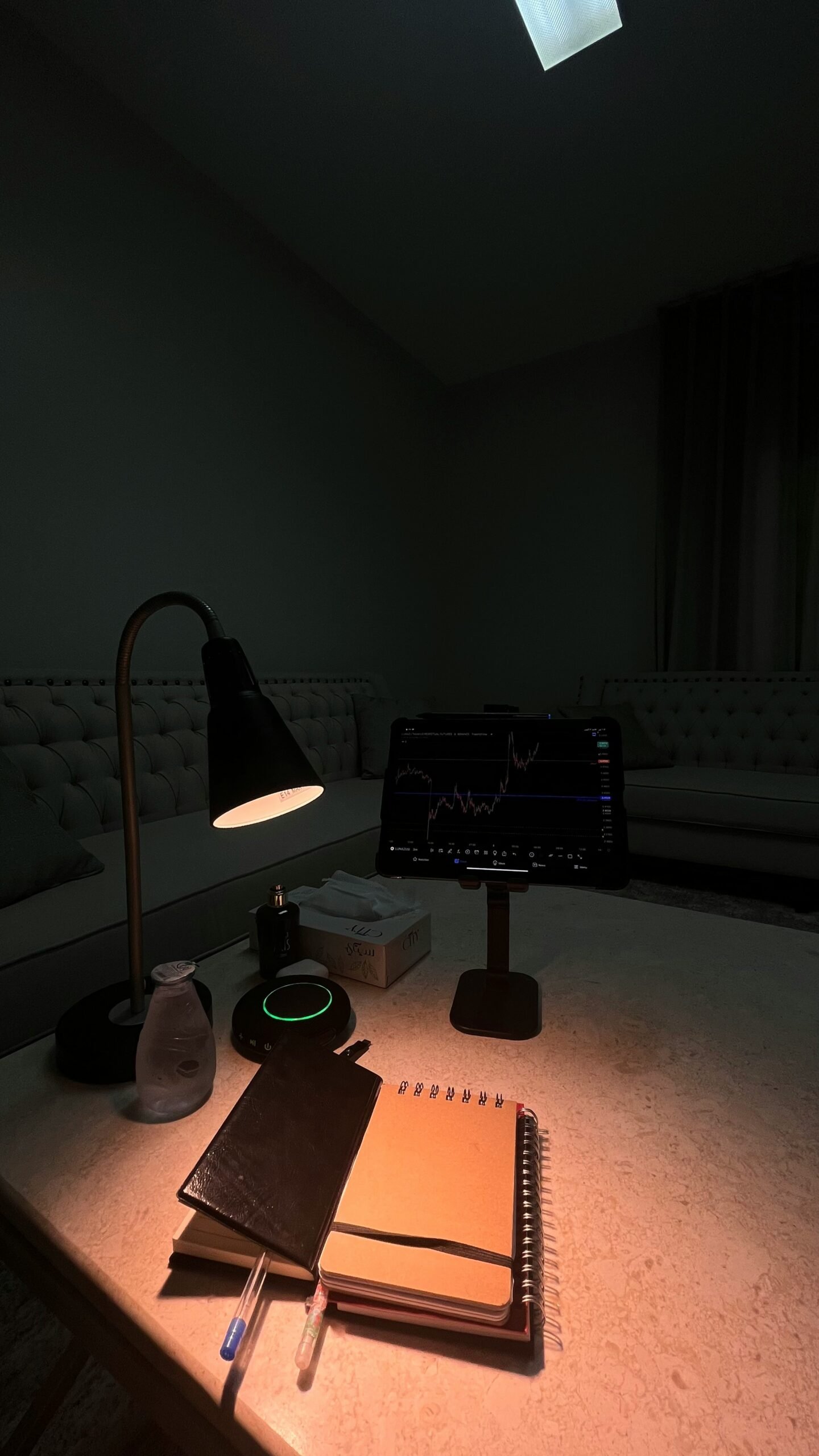

Technical analysis is a pivotal aspect of forex trading that involves evaluating historical price data to forecast future price movements. For beginners, understanding technical analysis can enhance the ability to identify profitable trading opportunities. It primarily revolves around the interpretation of price charts, which visually represent currency pair performance over time.

Price charts can come in various forms, including line charts, bar charts, and candlestick charts. Candlestick charts are particularly popular among traders due to the rich information they convey, including opening, closing, high, and low prices within a specific time frame. Each candlestick provides a snapshot of price movement and helps traders identify trends and reversals quickly.

To effectively analyze these charts, traders often employ various indicators that assist in trend identification and decision-making. One common tool is the moving average, which smooths out price data to identify the overall direction of the market. By examining both short-term and long-term moving averages, traders can better understand potential support and resistance levels. Another crucial indicator is the Relative Strength Index (RSI), which measures the speed and change of price movements, helping traders determine whether a currency pair is overbought or oversold.

Additionally, the Moving Average Convergence Divergence (MACD) indicator is useful for detecting changes in momentum. By analyzing the relationship between two moving averages of a security’s price, traders can spot potential buy and sell signals. Patterns such as head and shoulders, triangles, and flags also play a significant role in technical analysis, providing clues about market sentiments and possible price actions.

By mastering these technical analysis tools and chart reading techniques, forex trading beginners can develop a deeper understanding of market dynamics and enhance their trading strategies significantly.

Fundamental Analysis in Forex Trading

Fundamental analysis is a crucial component of Forex trading, as it allows traders to evaluate how various economic news and events can impact currency values. By analyzing economic indicators and understanding the broader financial context, traders can make more informed decisions. Among the key factors influencing currency prices are Gross Domestic Product (GDP), inflation rates, and employment data. These indicators provide insights into the economic health of a country and subsequently affect market sentiment regarding its currency.

Gross Domestic Product (GDP) is one of the primary indicators used in fundamental analysis. It represents the total value of all goods and services produced over a specific period within a country. A rising GDP generally signals a growing economy, which can strengthen the currency as investors seek to capitalize on the potential for economic expansion. Conversely, a declining GDP could weaken a currency as it reflects economic contraction and lowered investor confidence.

Inflation rates also play a significant role in determining currency values. High inflation can erode purchasing power, making a currency less attractive to investors. Central banks often respond to rising inflation by adjusting interest rates, which can directly impact the Forex market. Therefore, staying informed about inflation trends is essential for Forex traders. Meanwhile, employment data is another key indicator that analysts monitor closely. Healthy job growth typically signals economic stability, leading to a stronger currency, while rising unemployment rates can indicate economic distress, prompting currency depreciation.

Moreover, keeping abreast of global events, such as geopolitical tensions, natural disasters, or policy changes, is vital for traders. These events can lead to significant market volatility, causing currency values to surge or plunge within short spans. Comprehensive fundamental analysis requires traders to seek out reliable sources of information and interpret data accurately, equipping them with the insights needed to navigate the dynamic Forex market effectively.

Risk Management in Forex Trading

Effective risk management is a cornerstone of successful Forex trading, particularly for beginners. Understanding how to minimize potential losses while maximizing potential gains is crucial in navigating the volatile Forex market. One of the fundamental techniques is position sizing, which refers to determining how much capital to allocate to a particular trade. Proper position sizing allows traders to limit their exposure, ensuring that no single trade can devastate their entire account. A common rule is to risk only a small percentage of the trading capital on any given trade, often recommended at around 1-2%.

Another essential tool in risk management is the use of stop-loss orders. A stop-loss order is an instruction to close a trade when it reaches a certain loss threshold. This prevents disastrous losses by automatically exiting a losing trade, which is especially important in the fast-paced Forex environment where prices can fluctuate rapidly. Setting a stop-loss order should be a standard procedure for every trader, helping to safeguard the capital against unexpected market movements.

Additionally, understanding leverage is paramount in Forex trading. Leverage allows traders to access larger positions with a smaller amount of capital; however, it can magnify both gains and losses. Thus, employing leverage wisely is a crucial aspect of risk management. Traders must comprehend not only how leverage works but also the potential risks it entails, ensuring they do not allow emotions to dictate their trading decisions.

Emotional control is frequently overlooked but is a vital component of an effective risk management strategy. Fear and greed can lead to impulsive decisions that contradict one’s trading plan, often resulting in substantial losses. Developing a solid risk management plan, grounded in disciplined execution and emotional equilibrium, is essential in the journey to becoming a successful Forex trader.

Resources for Continued Learning

Embarking on a Forex trading journey in Kenya necessitates a commitment to continued education, as the financial markets are ever-evolving. Aspiring traders should equip themselves with diverse resources to stay informed and enhance their skills. One of the most effective ways to gain insight into Forex trading is through specialized books. Titles such as “Currency Trading for Dummies” by Kathleen Brooks and “Forex Trading: The Basics Explained in Simple Terms” by Jim Brown provide foundational knowledge for beginners. These texts cover essential concepts, strategies, and risk management.

Online platforms also offer considerable educational content that is invaluable for novice traders. Websites such as Investopedia, BabyPips, and Forex Factory provide articles, tutorials, and community forums where individuals can engage with experienced traders and gain insights. These platforms foster an environment of learning and discussion, allowing new traders to ask questions and share experiences.

In addition to literature and online resources, participating in Forex trading courses can significantly benefit aspiring traders. Many institutions and online platforms offer structured courses that cover a variety of topics, from basic trading principles to advanced strategies. Online platforms like Udemy and Coursera have a plethora of options tailored to different expertise levels, making them accessible and comprehensive.

Moreover, simulation tools and demo accounts are crucial for practical experience. Many Forex brokers offer demo accounts, allowing traders to practice trading without risking real funds. This hands-on experience enhances understanding of market dynamics and trading strategies. Tools like TradingView and MetaTrader 4 provide interactive charts and technical analysis features, aiding traders in their learning process.

Lastly, continuous learning is imperative in the fast-paced world of Forex trading. Traders should regularly follow financial news and market analysis to stay informed of economic events that influence currency prices. By leveraging these resources, aspiring traders can build a solid foundation and effectively navigate the complexities of Forex trading in Kenya.